Total Excess Car Insurance Meaning Steadfast Marine

In insurance, understanding the nuances of various policies is crucial to making informed decisions. One such policy that often perplexes individuals is Total Excess Car Insurance.

Total excess car insurance combines compulsory and voluntary excess amounts, impacting premiums. “Steadfast Marine” could represent a marine insurance provider specializing in comprehensive coverage for maritime risks.

In this article, we delve into the depths of Total Excess Car Insurance, elucidating its meaning, components, and the role of Steadfast Marine within this framework.

Table of Contents

ToggleUnderstanding Total Excess Car Insurance – Find Out More!

Total Excess Car Insurance, often referred to as Excess Insurance, is a supplementary policy designed to complement existing car insurance coverage.

Unlike traditional car insurance, which typically features a deductible paid by the insured in the event of a claim, Excess Insurance functions differently.

Instead of covering a portion of the claim, it covers the entirety of the excess amount above the deductible.

To grasp the concept more clearly, let’s consider an example. Suppose an individual holds car insurance with a $500 deductible.

If they were to file a claim for damages totaling $3,000, their primary insurance would cover $2,500, leaving the insured responsible for the $500 deductible.

However, with Total Excess Car Insurance in place, the entire $500 deductible would be covered, leaving the insured with no out-of-pocket expenses.

Components of Total Excess Car Insurance – Learn All About It!

Total Excess Car Insurance comprises several key components that dictate its functioning and coverage. These components include:

- Excess Amount: This refers to the portion of the claim the insured covers before the insurance kicks in. It is typically outlined in the primary insurance policy.

- Excess Insurance Limit: This denotes the maximum amount the Total Excess Car Insurance will cover. Ensuring this limit aligns with the deductible outlined in the primary insurance policy is essential.

- Premium: Like traditional insurance policies, Excess Insurance requires a premium payment. This premium amount can vary based on factors such as the insured’s driving history, the value of the vehicle, and the chosen coverage limits.

- Coverage Details: Total Excess Car Insurance may offer additional coverage beyond simply covering the deductible. This could include provisions for rental car reimbursement, roadside assistance, or coverage for uninsured motorists.

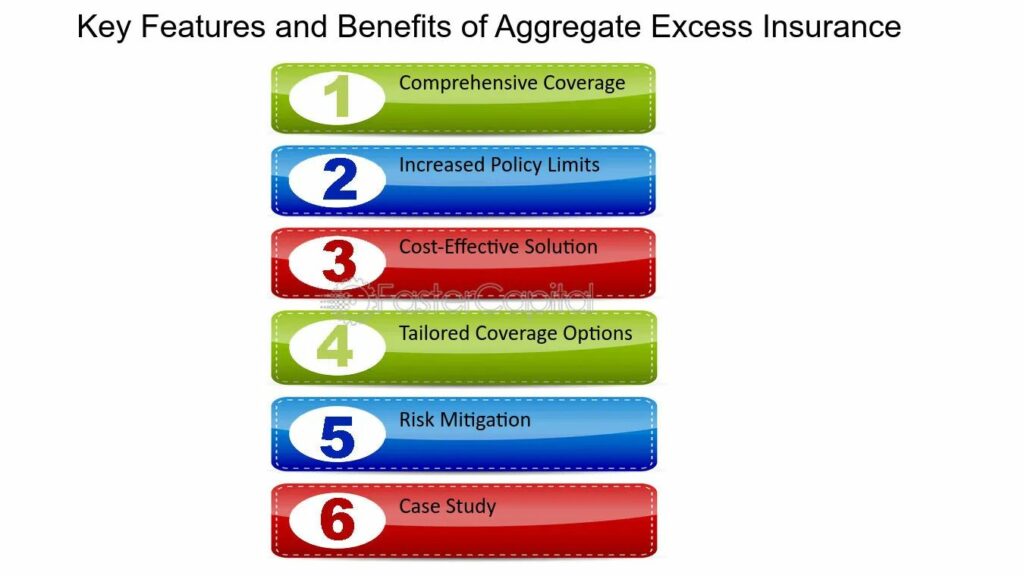

Benefits of Total Excess Car Insurance – Learn about them!

Opting for Total Excess Car Insurance offers several advantages to policyholders:

- Financial Protection: By covering the entirety of the deductible, Total Excess Car Insurance shields the insured from unexpected out-of-pocket expenses in the event of an accident or loss.

- Peace of Mind: Knowing that they are fully protected against excess expenses can provide peace of mind to drivers, allowing them to navigate the roads confidently.

- Enhanced Coverage: Total Excess Car Insurance often includes additional benefits such as rental car reimbursement or roadside assistance, further bolstering the insured’s coverage.

Read Also: WHO CAN FAMILY NURSE PRACTITIONERS WORK WITH?

Better Protection for Your Vehicle – Keeping You Safe On Land and Water!

Steadfast Marine coverage is a specialized insurance policy tailored to the unique risks faced by marine vessels and their operators.

While seemingly unrelated to car insurance, Steadfast Marine can play a crucial role in augmenting the coverage provided by Total Excess Car Insurance, especially in scenarios involving watercraft.

When a vehicle is transported via water, such as ferries or cargo ships, the risk of damage or loss extends beyond traditional road hazards.

Steadfast Marine coverage measures these risks, offering protection against perils such as sinking, collapsing, or theft while the vehicle is in transit.

When paired with Total Excess Car Insurance, Steadfast Marine coverage ensures comprehensive protection across land and sea.

This combined approach offers peace of mind to drivers who frequently transport their vehicles via waterways, knowing they are covered against a wide range of potential hazards.

Deciphering Total Excess Car Insurance – An Easy Guide with Steadfast Marine!

In car insurance, excess refers to the amount you agree to pay out of pocket when you claim before your insurance coverage kicks in. Total excess car insurance typically combines compulsory and voluntary excess amounts.

Compulsory Excess:

This is the amount set by your insurance provider that you must pay for any claim you make. It’s typically non-negotiable and can vary depending on your age, driving experience, and the type of vehicle insured.

Voluntary Excess:

In addition to compulsory excess, policyholders can choose to pay a voluntary excess. Opting for a higher voluntary excess often results in lower premiums, showing the insurer that you’re willing to take on more financial responsibility in the event of a claim.

Total Excess Car Insurance Meaning:

Total excess car insurance, therefore, refers to the combined compulsory and voluntary excess amounts agreed upon in a car insurance policy.

It represents the maximum amount the policyholder is responsible for paying towards a claim before the insurance company covers the rest.

Factors Affecting Total Excess:

Several factors influence the total excess amount in car insurance, including the type of coverage, the insurer’s policies, the insured vehicle’s value, the policyholder’s driving history, and their willingness to accept higher excess amounts in exchange for lower premiums.

Benefits and Considerations:

Opting for a higher total excess can lower premiums, making insurance more affordable. However, policyholders should consider their financial situation and the likelihood of choosing a high excess amount.

Conclusion on Total Excess Car Insurance:

Total excess car insurance plays a crucial role in determining the cost of premiums and the level of financial responsibility the policyholder assumes. Understanding the concept allows consumers to make informed decisions when purchasing car insurance.

Let’s discuss marine insurance and relate it to Steadfast Marine.

Read Also: FITOSTERINA – NATURE’S GIFT TO YOUR HEALTH!

Keeping Your Ships and Cargo Safe with Marine Insurance – Get Marine Insurance Today!

Marine insurance covers ships, cargo, terminals, and any transport or cargo by which property is transferred, acquired, or held between the points of origin and final destination.

- Hull Insurance: Covers damage to the vessel itself.

- Cargo Insurance: Covers damage to the goods being transported.

- Liability Insurance: Covers legal liabilities arising from the operation of the vessel.

- Importance of Marine Insurance: Marine insurance protects against the risks

associated with maritime activities, including natural disasters, accidents, piracy, and theft.

- Steadfast Marine (Hypothetical): While there isn’t specific information available about a company named “Steadfast Marine” as of my last update, hypothetically, it could be a marine insurance provider specializing in offering comprehensive coverage for marine-related risks.

Key Features of Steadfast Marine Insurance (Hypothetical):

- Tailored Policies: Steadfast Marine may offer customized insurance solutions to meet shipowners’, cargo owners, and other maritime entities’ unique needs.

- Comprehensive Coverage: Policies from Steadfast Marine might provide broad coverage for various risks encountered in marine operations, including hull damage, cargo loss, and liability claims.

- Competitive Premiums: Like other insurance providers, Steadfast Marine could strive to offer competitive premiums while ensuring sufficient coverage for policyholders.

- Expertise and Service: A company like Steadfast Marine may boast a team of experienced marine insurance professionals who provide expert advice and prompt claims settlement services.

FAQs:

1. How does total excess insurance work with Steadfast Marine?

With Steadfast Marine’s total excess insurance, you’ll only need to pay a fixed excess amount towards any claim, regardless of the total cost of repairs or replacement.

2. Is total excess insurance mandatory with Steadfast Marine?

Total excess insurance isn’t mandatory with Steadfast Marine, but it offers additional financial protection by reducing out-of-pocket expenses in case of an accident or mishap.

3. Can I choose my total excess amount with Steadfast Marine?

Yes, you can typically select your total excess amount with Steadfast Marine, allowing you to customize your coverage and adjust your premium accordingly.

4. What’s the benefit of having total excess insurance with Steadfast Marine?

Total excess insurance with Steadfast Marine provides peace of mind by capping your financial liability in the event of significant damage or loss to your vessel.

5. How do I file a claim with total excess insurance through Steadfast Marine?

To file a claim with total excess insurance from Steadfast Marine, simply contact their claims department and provide the necessary documentation and details about the incident.

Conclusion:

Total excess car insurance merges mandatory and optional excesses, influencing premium costs. “Steadfast Marine” may symbolize a specialized marine insurance company offering extensive coverage for maritime perils.

Read Also:

CASSASSE – A TRADITIONAL DISH WITH HISTORICAL SIGNIFICANCE!

6 BENEFITS OF WORKING WITH A TRUST MANAGEMENT COMPANY

You May Also Like

Balancing Work and Family Life: A Guide to Success

December 28, 2023

Liveleak Alternative – Find Out Everything You Need To Know!

March 5, 2024